18+ Petition Preparer Chapter 7

Consumers usually file chapter 7 or chapter 13. IRM 2181710 Covering Over Net Collections of Tax When the period of Limitations Has Expired - US.

Order On Debtor S Application For Waiver Of The Chapter 7 Filing Fee Edc 6

I-130 Petition for Alien Relative.

. Official Form 103B Application to Have the Chapter 7 Filing Fee Waived page1 Official Form 103B. 1 Undefined TermsAs used in 301 CMR 1100 any term not defined in accordance with 301 CMR 11022 shall have the meaning given to the term by any statutes regulations executive orders or policy directives governing the subject matter of the term. This page was last edited on 18 September 2022 at 1426 UTC.

Bankruptcy under Chapter 11 Chapter 12 or Chapter 13 is more complex reorganization and involves allowing the debtor to keep some or all of his or her property and to use future earnings to pay off creditors. The extension is with respect to tax shown or required to be shown on a return for any taxable year that includes 11112009. 602 added item for chapter 109B.

Anyone who is paid to prepare the return must sign the return in the space provided and fill in the Paid Preparer Use Only area. A trustee or a debtor-in-possession administers the bankruptcy estate. ASCII characters only characters found on a standard US keyboard.

A wetlands which is defined by the Wetlands. The debtor must also pay the entire filing fee to receive a discharge. 224 which directed amendment of table of chapters at the beginning of part I of this title by striking item relating to section 114 and inserting new item 114 was executed by adding item for chapter.

IRM 5119 Collection Statute Expiration. Code is treated as a separate taxable entity. Federal government websites often end in gov or mil.

Any approval by unit owners called for by this chapter or the applicable declaration or bylaws including but not limited to the approval requirement in s. See IRM 20163 Overview - Preparer Promoter Material Advisor and Failure to Disclose Reportable Transaction Penalties IRC 6694 Understatement of Taxpayers Liability by Tax Return Preparer and IRM 25129. Before sharing sensitive information make sure youre on a federal government site.

6 to 30 characters long. 18 sections 17951-1c 17951-2 and 17953 regarding taxability. 109177 title I 121g4B Mar.

This contrasts with a Chapter 13 bankruptcy which stays on an individuals credit report for 7 years from the date of filing the Chapter 13 petition. The bankruptcy estate that is created when an individual debtor files a petition under either chapter 7 or 11 of Title 11 of the US. 109248 title I 141a2 July 27 2006 120 Stat.

Notice 2010-30 IRB 2010-18 grants an extension of time to pay to 10152010 to certain qualifying spouses of military personnel. Send and eSign an unlimited number of documents online 100 FREE. Latest breaking news including politics crime and celebrity.

Failure To FileFailure To Pay Penalties. IRC 6511 Limitations on Credit or Refund. Examples include a term pertaining to.

We welcome your comments about this publication and your suggestions for future editions. If the preparer is culpable then the Return Preparer Coordinator in your Area Planning and Special Programs PSP must be contacted. 18 Land means the surface of a legally described parcel of real property and includes unless otherwise specified in the declaration and whether separate from or including such surface airspace lying above and subterranean space lying below such surface.

9 2006 120 Stat. NW IR-6526 Washington DC 20224. Have you promised to pay or do.

Federal government websites often end in gov or mil. Penalty Handbook Section 2. Entry documents to come to the United States.

However if so defined in the declaration the term land may mean all or any portion of the airspace or subterranean. This chapter shall not be construed to affect the validity of any provision of any declaration recorded prior to July 1 1998 provided however that this chapter shall be applicable to any development established prior to the enactment of the Subdivided Land Sales Act 551-2300 et seqi located in a county with an urban county. A Chapter 7 bankruptcy stays on an individuals credit report for 10 years from the date of filing the Chapter 7 petition.

Chapter 11 filings by individuals are allowed but are rare. Before sharing sensitive information make sure youre on a federal government site. Whoever in any matter within the jurisdiction of the Service knowingly and willfully fails to disclose conceals or covers up the fact that they have on behalf of any person and for a fee or other remuneration prepared or assisted in preparing an application which was falsely made as defined in subsection f for immigration benefits shall be fined in accordance with title 18.

More property to an attorney bankruptcy petition preparer or anyone else in connection with the bankruptcy case. Refi Rates Today December 7 2022 Rates Stay Under 675 new 6 min read. IRM 217 Business Tax Returns and Non-Master File Accounts.

1GB of storage is available under a free account. 18 2022 USCIS began implementing a new process that provides safe and orderly means for nationals of Venezuela and their qualifying immediate family members who are outside the United States and who lack US. To inform the taxpayer of the opportunity and right to petition the Tax Court to dispute the proposed adjustments.

Chapter 12 is similar to Chapter 13 but is available only. IRC 6501 Limitations on Assessment and Collection. A A generator may accumulate as much as 55 gallons of non-acute hazardous waste andor either one quart of liquid acute hazardous waste listed in 26131 or 26133e of this chapter or 1 kg 22 lbs of solid acute hazardous waste listed in 26131 or 26133e of this chapter in containers at or near any point of generation where.

Find stories updates and expert opinion. The UK regulator signaled an in-depth review of Microsofts 687 billion deal to acquire Activision Blizzard last month and the CMA has now published its full 76-page report on its findings. The executor of a decedents estate uses Form 706 to figure the estate tax imposed by chapter 11 of the Internal Revenue Code.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. The gov means its official. 7181118 must be made at a duly noticed meeting of unit owners and is subject to all requirements of this chapter or the applicable condominium documents relating to unit owner.

See section 7701a36B for exceptions. Todays Mortgage Rates December 7 2022 Rates Remain Below 67 new 7 min read. The gov means its official.

I-765 Application for Employment. No signup or credit card required. Therefore a copy of a notice of deficiency will not be sent to an unenrolled return preparer or a registered tax return preparer.

Must contain at least 4 different symbols.

U S C Title 11 Bankruptcy

How Long Does Chapter 7 Bankruptcy Usually Take Debt Org

Can I File For Bankruptcy Online Upsolve

Can You File For Bankruptcy Online

U S C Title 11 Bankruptcy

How To File Bankruptcy Yourself Richard West Law Office

How To File Bankruptcy Online Chapter 7 Chapter 13

Petition Preparer Prevails Against Bankruptcy Court Bankruptcy Law Firm

Order Of Discharge Chapter 13 B3180w Pdf Fpdf Docx Official Federal Forms

How To Hire A Bankruptcy Petition Preparer 14 Steps

Bankruptcy Forms

Declaration And Signature Of Non Attorney Bankruptcy Petition

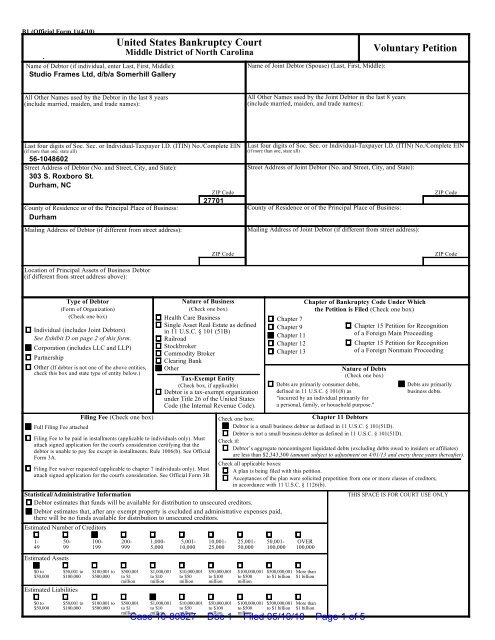

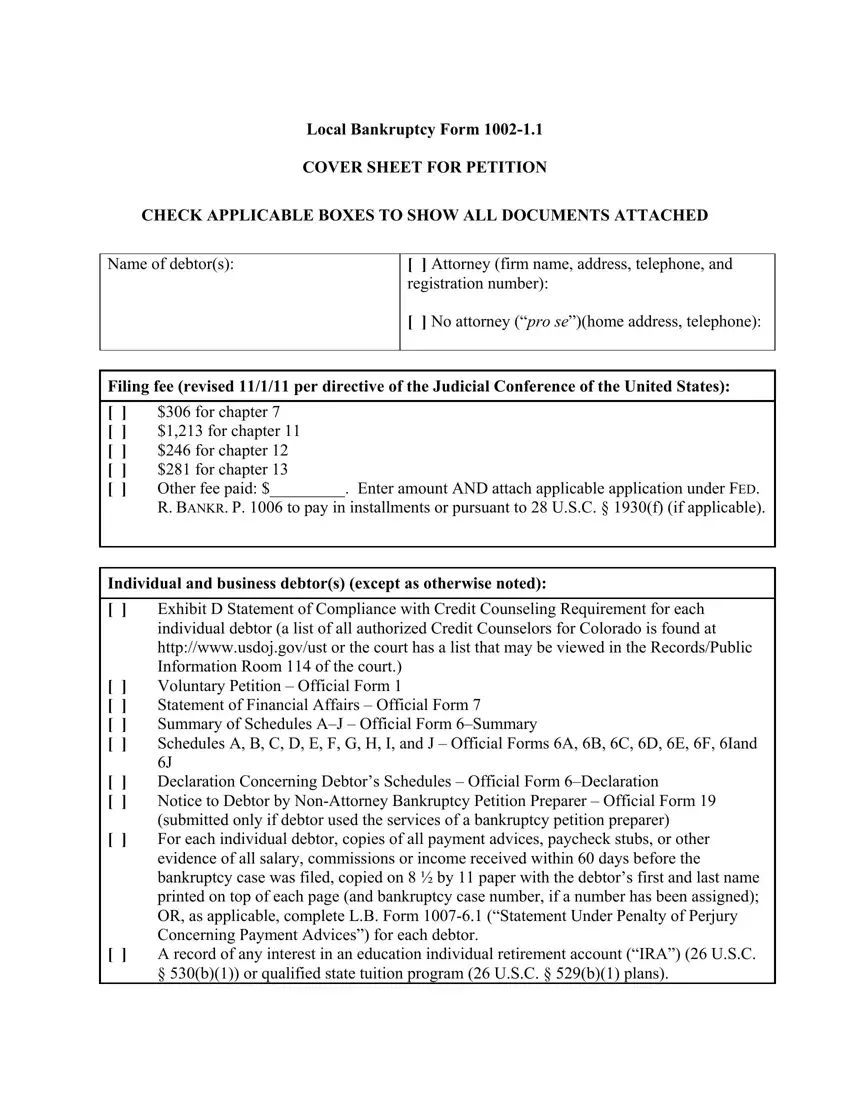

Bankruptcy Cover Sheet Petition Pdf Form Formspal

Bankruptcy Attorney Vs Bankruptcy Petition Preparer

Form B 19 Declaration And Signature Of Non Attorney Bankruptcy Petition Preparer 12 07

How To Hire A Bankruptcy Petition Preparer 14 Steps

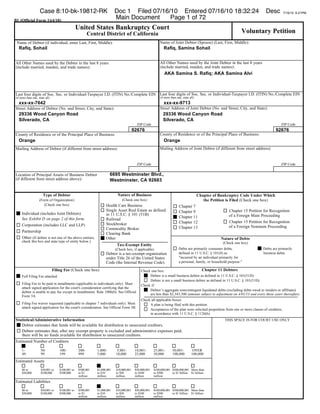

Rafiq Bankruptcy